- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

Valua Partners provides CFO-grade leadership and finance execution: a predictable month-end close, rolling 13-week cash forecasting, KPI dashboards, capital markets support, and stakeholder-ready reporting. We operate as an extension of your leadership team across Canada and the U.S. without building a large in-house finance department.

Valua Partners provides CFO-grade leadership and finance execution: a predictable month-end close, rolling 13-week cash forecasting, KPI dashboards, capital markets support, and stakeholder-ready reporting. We operate as an extension of your leadership team across Canada and the U.S. without building a large in-house finance department.

Our engagements are scoped to your entity structure, transaction volume, and stakeholder reporting needs. Start with a CFO Health Check, then select the package that matches your priorities, board reporting, treasury/cash, M&A support, or capital raising, with clear and enterprise-grade deliverables.

We work with management to develop long-term financial goals and strategies by using financial forecasts that create actionable insights.

Optimize liquidity, payments, & working capital while staying within policy; daily visibility, weekly 13-week cash, & disciplined controls.

We provide companies with strategic financial advice and support through the M&A deal lifecycle to maximize value and minimize risk, offering expertise in strategic planning, due diligence support, valuation analysis, negotiation support, and post-merger integration.

Institutional-grade materials & lender-ready numbers for equity, private credit, venture debt, or bank facilities.

CFO impact comes from two things: a predictable operating cadence and the right decision support. Our 3-step approach establishes a clear reporting rhythm, strengthens cash control, and delivers board and lender-ready numbers without building a large in-house team.

We start with a CFO Health Check to understand your goals, stakeholder requirements, and current finance maturity. We review your close process, reporting, cash visibility, and controls, then define the scope, cadence, and success metrics for the engagement.

We implement a repeatable rhythm for finance leadership: monthly reporting packs, KPI dashboards, forecasting models, and a cash cadence (including a rolling 13-week forecast when required). We also define approvals, responsibilities, and documentation standards so decisions are based on consistent, reliable numbers.

Your dedicated CFO lead runs ongoing advisory and stakeholder reporting, with recurring reviews to improve performance. We deliver board- and lender-ready packages, manage cash and working capital priorities, and support key events such as fundraising, debt renewals, audits, or M&A as needed.

We provide CFO leadership plus a disciplined operating cadence, forecasting, board & lender reporting, treasury visibility, and audit-ready controls. Here are the questions we hear most from management evaluating a CFO partner.

A Fractional CFO owns strategy, forecasting, stakeholder reporting, and finance leadership decisions. A Controller owns accounting accuracy, close execution, and controls. We can provide both layers, so you get CFO guidance backed by a reliable finance engine.

Our clients are on a monthly retainer scoped to entity count, complexity, reporting cadence, and stakeholder requirements. Transaction work (fundraising, M&A, financings) is typically scoped separately with clear deliverables and timelines.

We start with a triage-and-catch-up plan: reconcile the balance sheet, address compliance gaps, and rebuild a close calendar. Once stabilized, we transition you into a repeatable monthly cadence with clean documentation and clear owners.

Yes. We coordinate PBC requests, support schedules, and reporting packages, and align monthly close outputs with audit and tax requirements. If you already have trusted partners, we integrate directly to reduce year-end friction.

We use role-based access, least-privilege permissions, documented approvals, and secure file sharing. We can align to your internal security requirements and implement segregation of duties across payments, journals, and key workflows.

Valua Partners embeds a CFO lead and controller-grade execution into your workflow to deliver predictable close cadence, clean reporting, and decision support. You get board- and lender-ready financials, cash visibility, and stronger controls, without building a full internal finance department.

Deliverables follow a consistent, board-ready format to ensure clarity, continuity, and audit readiness month after month.

Every engagement includes a named CFO lead and controller-grade oversight, with direct access to your team and a consistent monthly reporting cadence.

Rolling 13-week liquidity forecast, updated weekly with variance tracking and actions.

Monthly reporting pack: KPIs, variance commentary, covenant tracking, and stakeholder-ready narratives.

Close calendar with owners, deadlines, and approvals - built to achieve a 10-business-day close (scope dependent).

Audit-ready schedules and support files are prepared every month to reduce year-end friction.

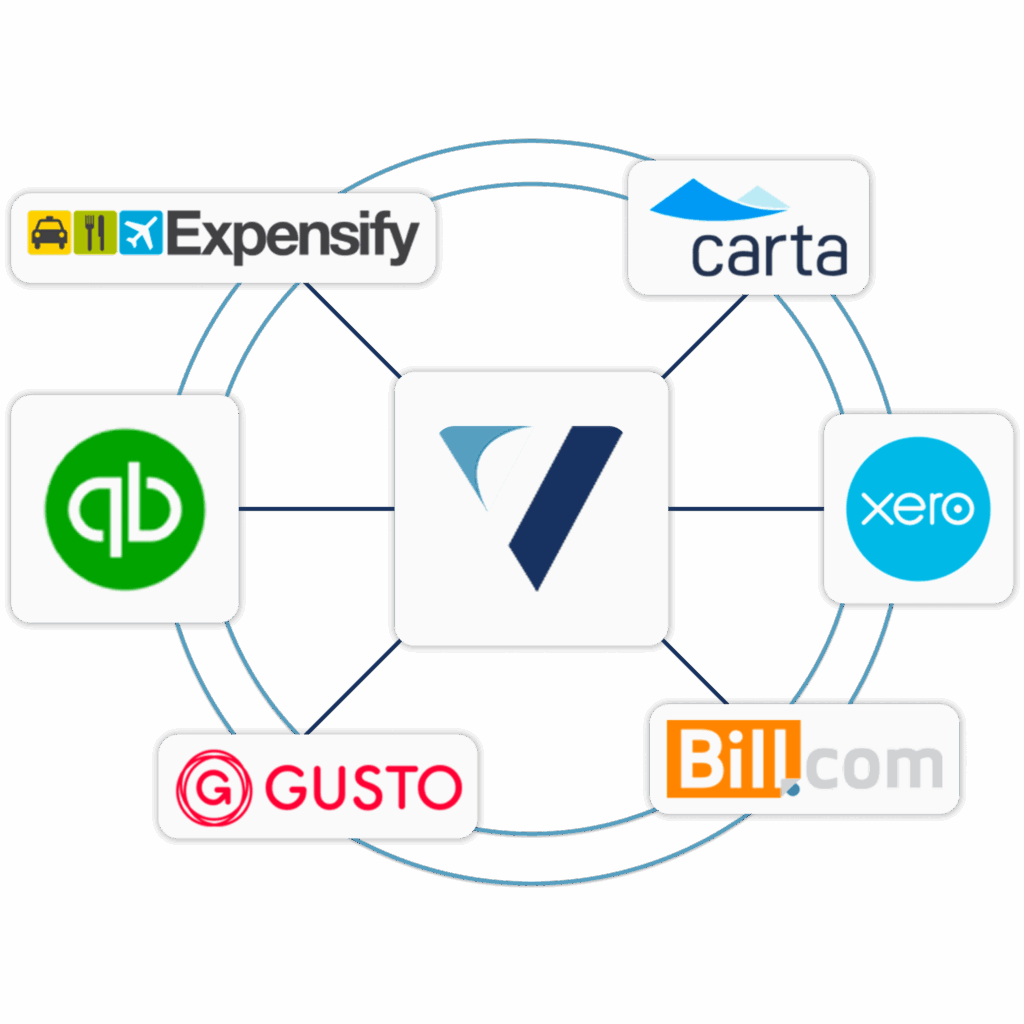

We integrate into your existing finance stack, or modernize it, without disrupting operations. Our implementations prioritize segregation of duties, documented approvals, and least-privilege access so your close, treasury, and reporting processes are reliable and audit-ready. You get clean data flowing from source systems to board and lender reporting with clear ownership and change control.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.