- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

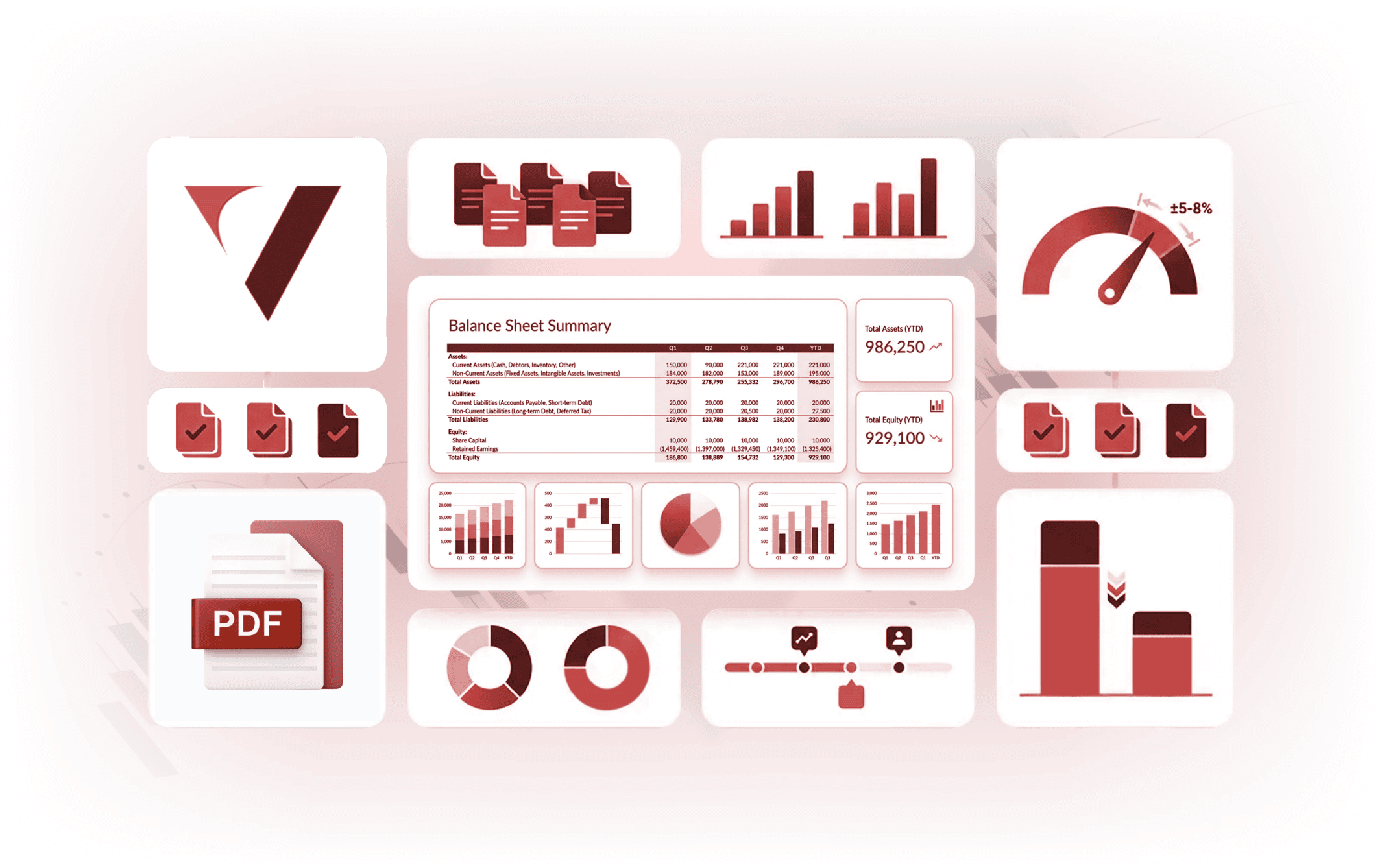

Our tools from Valua Partners will feature essential strategies and trends in taxes, bookkeeping, and outsourced CFO services. Stay ahead with our resources designed to support your business’s financial growth.

Explore our tools from Valua Partners, featuring essential strategies and trends in taxes, bookkeeping, and outsourced CFO services. Stay ahead with our resources designed to support your business’s financial growth.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

From SaaS and manufacturing to multi-location retail and Web3, Valua Partners supports management teams where finance precision determines growth velocity.

A financial model is a structured representation of how a business performs financially and how it may perform in the future under different assumptions. At its best, it helps leaders connect operating drivers (pricing, volume, headcount, utilization, churn, etc.) to outcomes (profitability, cash flow, and funding needs), so decisions become measurable instead of subjective.

Practical guides, checklists, and financial templates built by Valua Partners. Learn how high-performing finance teams stay audit-ready, investor-ready, and in control – across tax, reporting, systems, and strategy.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Create your own 3-statement model for a company – specifically, the balance sheet, income statement, and statement of cash flows. This template should be used to understand how the 3 financial statements work in unison. Just enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.