- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

ARR/MRR + deferred revenue done right, plus churn, cohorts, runway, and investor-ready reporting. We build the finance cadence, controls, and models growth-stage teams need to scale with confidence.

ARR/MRR + deferred revenue done right, plus churn, cohorts, runway, and investor-ready reporting. We build the finance cadence, controls, and models growth-stage teams need to scale with confidence.

From SaaS and manufacturing to multi-location retail and Web3, Valua Partners supports management teams where finance precision determines growth velocity.

We help you replace spreadsheet chaos with clarity that accelerates funding, confidence, and growth.

Stop rebuilding ARR, churn, and runway in spreadsheets every month. We standardize revenue recognition, consolidate multi-entity reporting, and deliver consistent board packs – so diligence is easier, decisions are faster, and the numbers don’t change mid-conversation.

We turn SaaS finance into repeatable, audit-ready deliverables, so ARR, churn, CAC payback, and runway are consistent month to month. From ASC 606 revenue schedules to investor-grade board packs and 13-week cash visibility, your numbers stay defensible for fundraising, audits, and diligence.

Automated rev-rec schedules for subscriptions, contracts, upgrades, and refunds - built to reconcile cleanly to the GL.

Driver-based forecasts for ARR, churn, CAC payback, burn, and runway - plus downside/base/upside scenarios.

A single source of truth across bookings, revenue, retention, spend, and unit economics - built for leadership reviews.

A consistent monthly pack with KPIs, variance explanations, runway, and key decisions - ready for investors and lenders.

Weekly cash visibility that connects AR/AP, payroll, and planned spend - so decisions happen before surprises.

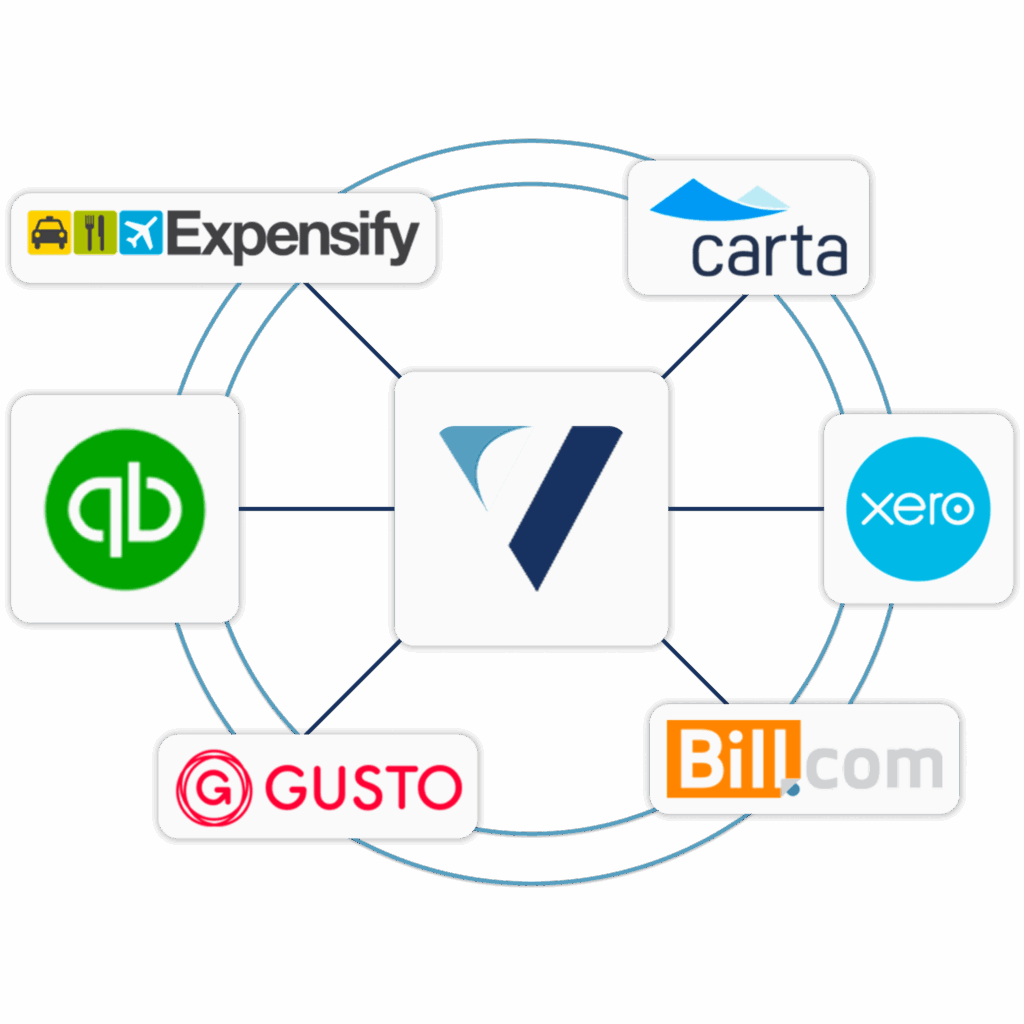

We design and optimize your finance stack so revenue, payroll, spend, and equity data flow cleanly end-to-end. Access controls, approvals, and audit trails are configured from day one, so reporting is reliable, close is faster, and investor diligence is painless.

SaaS finance gets complex fast, revenue recognition, subscription billing data, investor metrics, and investor reporting readiness. Here are the questions we hear most, and how Valua supports high-growth teams.

From ARR tracking to rev-rec automation, Valua Partners gives you clarity, compliance, and control.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.