- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

Capital stack reporting, project controls, and portfolio consolidation, run by a CFO team built for multi-entity groups, complex waterfalls, and lender/investor scrutiny. From draws to cost-to-complete, we keep every number defensible.

Capital stack reporting, project controls, and portfolio consolidation, run by a CFO team built for multi-entity groups, complex waterfalls, and lender/investor scrutiny. From draws to cost-to-complete, we keep every number defensible.

From SaaS and manufacturing to multi-location retail and Web3, Valua Partners supports management teams where finance precision determines growth velocity.

We unify project, entity, and investor reporting – so budgets, draws, and cost-to-complete stay defensible across every deal.

Real estate and construction groups don’t just close months – they manage draws, cost-to-complete, JV allocations, and lender reporting across multiple entities and stakeholders. Valua Partners builds the finance operating system behind your projects: disciplined close cadence, audit-ready schedules, and board- and lender-grade reporting that stays accurate as plans change.

Real estate finance breaks when reporting is built project-by-project and patched together at quarter-end. We build a consistent reporting engine across your portfolio, so every draw request, covenant package, investor update, and tax schedule ties back to the same reconciled source data. The result: faster closes, fewer lender questions, and cleaner audit trails across entities and projects.

Consolidated reporting across HoldCos, LPs, GP entities, SPVs, and joint ventures, built to withstand investor and lender scrutiny.

Draw schedules, uses of funds, budget vs. actual, and lender-ready reporting formatted to your credit agreements and reporting cadence.

CTC schedules, variance analysis, committed cost tracking, and early-warning visibility into overruns, scope drift, and margin compression.

Covenant schedules, compliance packages, and supporting documentation organized for audits, lender reviews, and due diligence requests.

Project and portfolio cash forecasting tied to draws, payables, construction timelines, and funding events, so liquidity is managed proactively.

Partnership/JV reporting support, allocation-ready schedules, and tax-ready packages that reconcile cleanly to project financials (and don’t get rebuilt at filing time).

Development finance is high-stakes, multiple entities, lender requirements, and investor reporting all need to reconcile cleanly. We build a reporting and controls layer that scales across projects, supports audits and draws, and keeps stakeholders aligned.

Yes. We support multi-entity real estate structures including HoldCos, LPs, GP entities, SPVs, and joint ventures. We build consistent rollups, ownership tracking, and reporting that ties project-level activity back to entity financials, so investor reporting and tax-ready schedules don’t become a rebuild at year-end.

Yes. We prepare lender-ready reporting packages aligned to your loan agreements and reporting cadence, draw packages, covenant schedules, liquidity updates, and supporting documentation. Our focus is to reduce lender questions by ensuring every number ties back to reconciled books and clear backup.

We support the tracking and reporting side, eligibility documentation organization, unit-level tracking, reconciliations, and coordination of filing support with your tax advisors where needed. The goal is a clean workflow that prevents missed rebates and avoids avoidable CRA follow-up.

We build cost-to-complete using a controlled methodology: committed costs + approved change orders + vendor invoices + updated projections, tied to budgets and draws. You’ll get variance visibility (by trade/package and project), early warning flags, and a reporting cadence that keeps forecasts reliable.

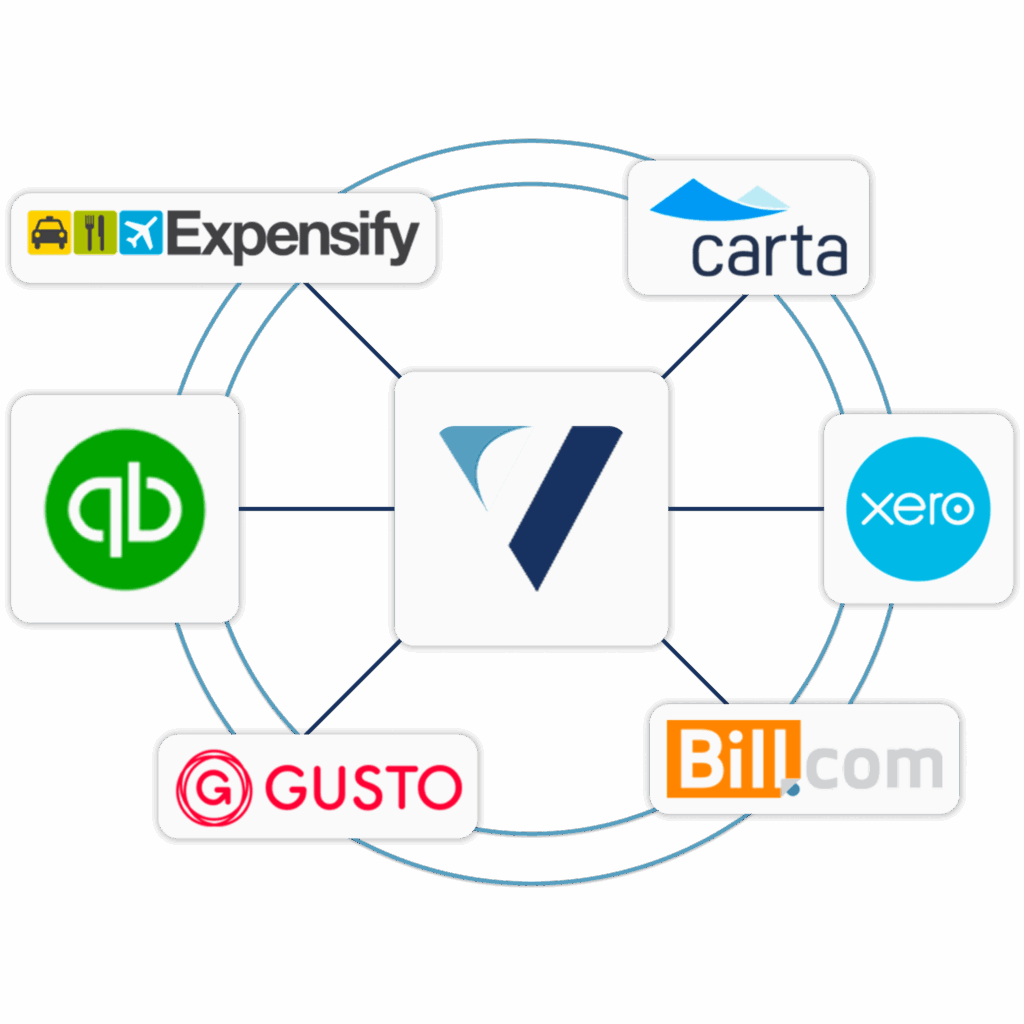

Yes. We integrate with the stack you already use (project management, AP, payroll, and accounting/ERP). We map project codes/cost categories, standardize the chart of accounts, and create clean flows so project data turns into financial reporting without manual spreadsheet consolidation.

Yes. We standardize reporting across projects and jurisdictions so leadership and investors can compare performance consistently, without every project becoming its own custom model.

Yes. We organize working papers, backup schedules, and reporting packages to support audits, lender reviews, and investor diligence, so requests are handled quickly and with a consistent source of truth.

We support tax-ready close and filing coordination by producing reconciled schedules, rollforwards, and reporting packages that your tax preparers can file from confidently. If you want us to handle filings directly, we scope it based on entity count, jurisdictions, and complexity.

Yes. We support multi-entity real estate structures including HoldCos, LPs, GP entities, SPVs, and joint ventures. We build consistent rollups, ownership tracking, and reporting that ties project-level activity back to entity financials, so investor reporting and tax-ready schedules don’t become a rebuild at year-end.

Yes. We prepare lender-ready reporting packages aligned to your loan agreements and reporting cadence, draw packages, covenant schedules, liquidity updates, and supporting documentation. Our focus is to reduce lender questions by ensuring every number ties back to reconciled books and clear backup.

We support the tracking and reporting side, eligibility documentation organization, unit-level tracking, reconciliations, and coordination of filing support with your tax advisors where needed. The goal is a clean workflow that prevents missed rebates and avoids avoidable CRA follow-up.

We build cost-to-complete using a controlled methodology: committed costs + approved change orders + vendor invoices + updated projections, tied to budgets and draws. You’ll get variance visibility (by trade/package and project), early warning flags, and a reporting cadence that keeps forecasts reliable.

Yes. We integrate with the stack you already use (project management, AP, payroll, and accounting/ERP). We map project codes/cost categories, standardize the chart of accounts, and create clean flows so project data turns into financial reporting without manual spreadsheet consolidation.

Yes. We standardize reporting across projects and jurisdictions so leadership and investors can compare performance consistently, without every project becoming its own custom model.

Yes. We organize working papers, backup schedules, and reporting packages to support audits, lender reviews, and investor diligence, so requests are handled quickly and with a consistent source of truth.

We support tax-ready close and filing coordination by producing reconciled schedules, rollforwards, and reporting packages that your tax preparers can file from confidently. If you want us to handle filings directly, we scope it based on entity count, jurisdictions, and complexity.

We bring order, accuracy, and accountability to your real estate and development finance operations.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.