- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

Standard costing, margin analytics, inventory controls, and multi-location reporting, built for high-volume operations that need reliable numbers, fast closes, and board-ready visibility.

Standard costing, margin analytics, inventory controls, and multi-location reporting, built for high-volume operations that need reliable numbers, fast closes, and board-ready visibility.

From SaaS and manufacturing to multi-location retail and Web3, Valua Partners supports management teams where finance precision determines growth velocity.

We help you track, cost, and forecast every part of your operation – in real time.

Margins in manufacturing and distribution are tight – small inefficiencies ripple through the entire operation. Valua Partners builds systems that make your financial performance visible and actionable, from factory floor metrics to boardroom decisions.

We connect production, inventory, purchasing, and the general ledger, so margins are trusted, the close is faster, and leadership sees the same numbers of operators run on.

Monthly close packages, covenant schedules, and KPI dashboards that stand up to diligence.

Reconciled inventory and cost of sales with clear tie-outs to ERP, warehouse, and cycle counts.

Weekly material, labor, and overhead variance reporting, built to explain what changed and why.

Standard cost builds, routing/BOM logic, overhead allocation, and multi-site consistency, by SKU and location.

Budgets, capitalization policies, and audit-ready support schedules, kept current from approval to in-service.

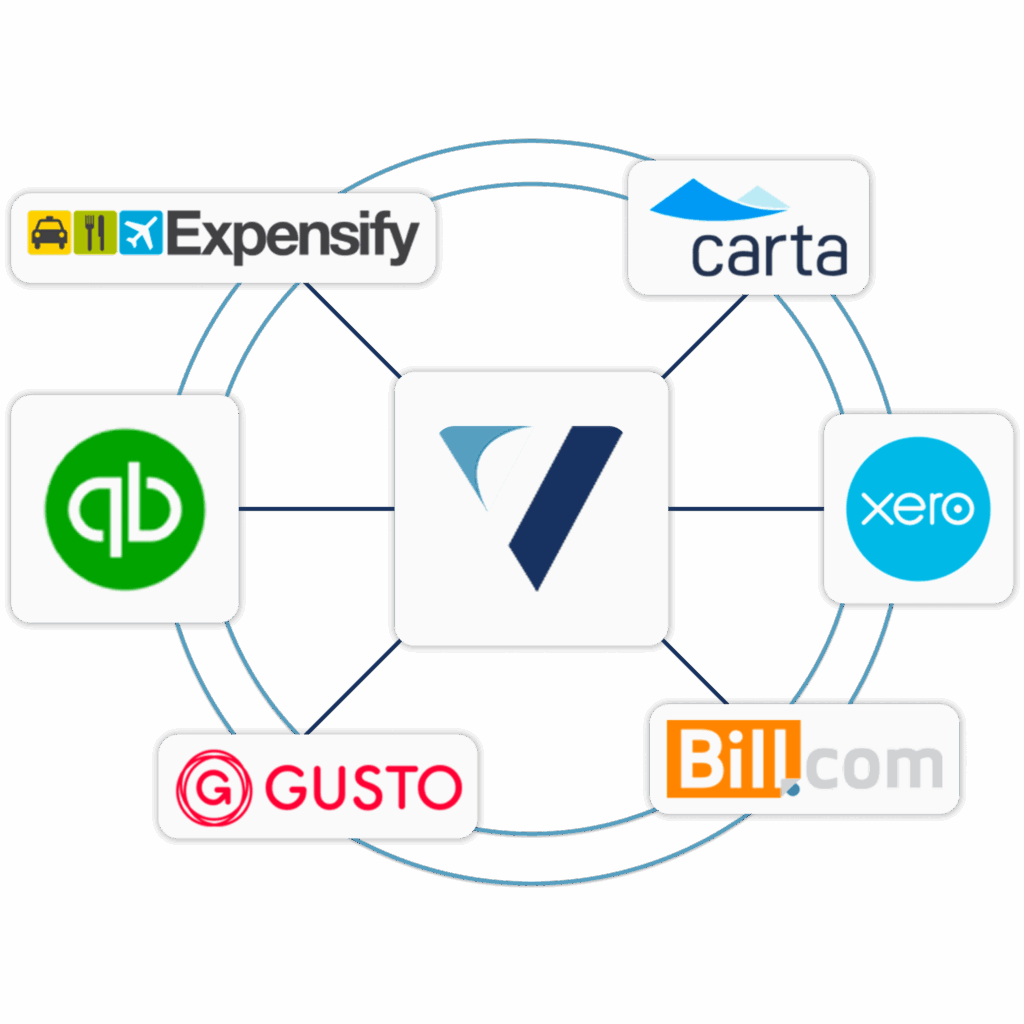

We integrate your finance function with leading ERP and accounting platforms – and link directly to your production or POS systems for seamless data flow. No more manual reconciliations or siloed spreadsheets.

Get clear answers on ERP integrations, inventory controls, multi-site reporting, and how we help you tighten margins without slowing operations.

Yes. We work inside your current ERP and finance stack (e.g., NetSuite, SAP, Microsoft Dynamics, QuickBooks + inventory tools). We map data flows, validate master data, and build reconciliations so production, inventory, and the GL stay aligned.

Absolutely. We set up entity/location reporting, intercompany processes, and standardized chart-of-accounts structures so consolidated financials are consistent – across plants, warehouses, and operating units.

We build a repeatable variance process that connects cycle counts, receiving, production output, scrap, and standard cost assumptions. You get weekly variance visibility (materials, labor, overhead), root-cause analysis, and a clear action plan to prevent recurring surprises.

Yes. We manage capitalization policies, project coding, progress tracking, and support schedules for audits, lenders, and grant requirements. We also help tie CAPEX to operational KPIs so leadership sees ROI, not just spend.

Yes. We prepare audit-ready working papers, lead PBC coordination, and support technical accounting positions as needed, so audits run faster with less disruption to your team.

Yes. We design and maintain standard costing frameworks (BOMs/routings, labor rates, overhead allocation), and implement controls to keep standards current as volumes, inputs, and processes change.

Yes. We streamline close checklists, reconciliations, cut-off procedures, and inventory/COGS tie-outs, so close becomes predictable, faster, and less dependent on heroics.

Yes. We build covenant schedules, borrowing base reporting (where applicable), and monthly lender packages, designed to match lender definitions and reduce back-and-forth.

We support established operators and growth-stage companies, from single-site to multi-location groups, especially where inventory, costing, or operational complexity is creating reporting risk or margin leakage.

Most engagements are fixed-fee with defined deliverables (e.g., close stabilization, costing rebuild, ERP reporting layer, consolidation setup). Pricing depends on site/entity count, ERP complexity, inventory flows, and timeline urgency.

From costing to cash flow, our CFO team brings structure, speed, and clarity to manufacturing finance.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.