- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

From cross-border structuring and transfer pricing to investor/IPO readiness, we bring CFO-led rigor to your tax position. Expect clean documentation, proactive planning, and coordinated execution across your accounting, finance, and external advisors, so you stay compliant while scaling.

From cross-border structuring and transfer pricing to investor/IPO readiness, we bring CFO-led rigor to your tax position. Expect clean documentation, proactive planning, and coordinated execution across your accounting, finance, and external advisors, so you stay compliant while scaling.

Complex tax and finance issues rarely fit a template. With 40+ years of combined CFO, controller, and tax leadership, we solve multi-jurisdiction, multi-entity, and transaction-driven problems with clear scopes, defensible documentation, and execution support. Choose the package that matches your complexity today, then scale as your structure evolves.

Design cross-jurisdictional entity structures that minimize double taxation, align with transfer pricing policies, and reduce foreign reporting risk.

Design, benchmark & document intercompany pricing to satisfy regulatory requirements and align with your operating model.

Prepare the finance function for investors, exchanges, & regulators including a clean structure, GAAP/IFRS-ready financials, and a disciplined disclosure process.

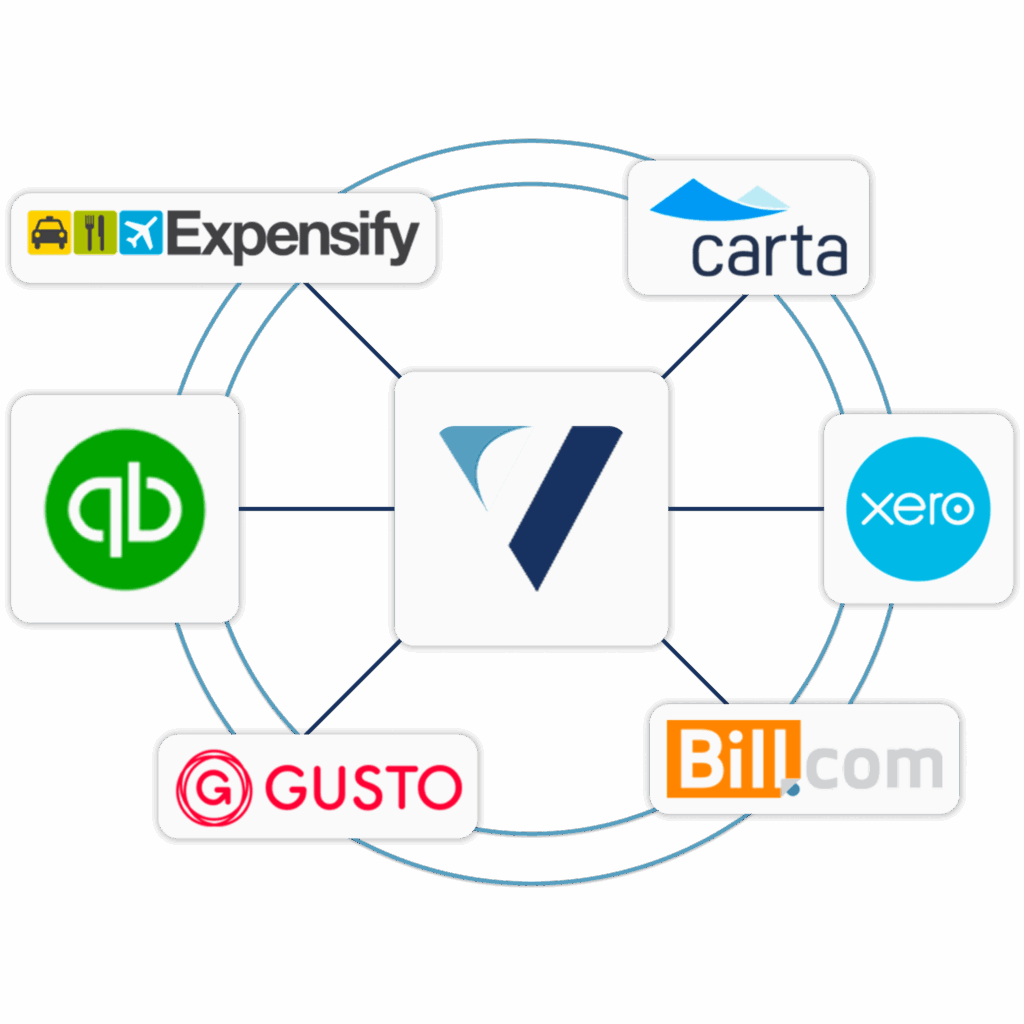

Select, implement & optimize ERP/finance stacks (Intacct/NetSuite/D365 BC) to enable multi-entity consolidation, controls, and fast closes.

On-demand executive advisory for board-level decisions: structure, capital, cross-border, working capital, and operating model trade-offs.

We have achieved 100% on-time filings and maintained full CRA compliance with zero penalties across our client portfolio. Additionally, our clients experience 60% fewer audit adjustments compared to the industry standard.

We review your current compliance posture – HST, payroll, and year-end data – and identify gaps or missed filings.

We fix issues, reconcile filings, and implement repeatable submission calendars that prevent future delays.

Our team takes over recurring compliance processes, ensuring every filing is handled correctly and on time.

Complex tax work breaks when timelines slip, assumptions aren’t documented, or stakeholders aren’t aligned. We bring structure to cross-border filings, transfer pricing, and investor readiness – coordinating with your finance team and advisors so every submission is accurate, consistent, and on time.

When the stakes are cross-border, multi-entity, or investor-facing, you need more than filings – you need a defensible plan, clean execution, and documentation built for scrutiny. We deliver board-grade work products you can rely on.

Structure U.S./Canada/international operations to reduce double taxation, clarify flow-of-funds, and align ownership, banking, and reporting, built to work in the real world, not just on paper.

Policy, pricing logic, and documentation that hold up: intercompany agreements, transaction mapping, support schedules, and audit-ready workpapers aligned to how value is created.

Turn complexity into confidence, quality of earnings support, tax position memos, reporting packages, and readiness workflows that speed diligence and reduce last-minute surprises.

Fix the infrastructure behind the numbers: chart of accounts, controls, integrations, permissions, and close workflows, so tax, finance, and reporting stay consistent as you scale.

CFO-level support for complex decisions, scenario planning, cash and capital strategy, risk framing, and stakeholder-ready narratives that connect operations, tax, and finance.

Whatever problem you’re dealing with, we’ll outline the approach, scope, and deliverables.

We work inside your current stack, or implement the right one, to create clean, reviewable workflows. Every process is built with role-based access, segregation of duties, and documented audit trails so filings, reporting, and support schedules hold up under scrutiny.

Get clear answers on scope, confidentiality, timelines, and how we handle complex, multi-entity work, so you can move forward with confidence.

Yes, when it’s within our engagement scope and jurisdiction. We can prepare and file the required returns, or coordinate filing with your existing CPA/tax counsel when that’s the best fit. Either way, we own the deliverables, timelines, and documentation so nothing falls through the cracks.

We handle catch-ups end-to-end: reconcile what’s missing, rebuild clean support schedules, correct prior filings where required, and implement a forward calendar so you stay current. If CRA/agency outreach is already in motion, we manage communications and responses with disciplined documentation.

Yes. We specialize in multi-entity and cross-border groups where alignment matters – entity structure, intercompany flows, FX, treaty positions, and consistent reporting across jurisdictions. Our goal is defensible compliance without breaking operations.

Yes. We help design intercompany policies and documentation that match how value is created, transaction mapping, support schedules, and audit-ready workpapers. We coordinate with legal/tax counsel when needed to ensure the structure and contracts align.

Yes. We prepare investor-grade materials like tax position memos, support schedules, close/readiness workflows, and reporting packages that reduce diligence friction. We also coordinate directly with your bankers, auditors, and counsel to keep the process moving.

We operate like a senior finance + tax function, not a filing desk. That means clear scopes, documented assumptions, repeatable workflows, and board-grade work products. You get structure, accountability, and defensible documentation – built for scrutiny.

Most engagements are fixed-fee and scoped based on entity count, jurisdictions, complexity, and deliverables (e.g., structuring memo, TP documentation, readiness package). If something is truly open-ended (like an active dispute), we define phases with clear checkpoints.

Typically: (1) a short discovery call, (2) a document request + quick diagnostic, (3) a scoped plan with deliverables and timelines. If you have a deadline (audit, financing, filing), we’ll prioritize the critical path first.

We use secure file handling and controlled access processes, and we can align to your internal requirements (role-based access, audit trails, and documented approvals). We only request what’s necessary and keep documentation organized for review.

Absolutely. We integrate into your existing team, define responsibilities, and run a clean workflow for data, deliverables, and sign-offs – so everyone stays aligned and rework is minimized.

Yes. We support companies with digital asset activity, including documentation and workflow design for wallet activity, treasury controls, and coordination with tax specialists where needed – so reporting and compliance are defensible.

We work with both high-growth and established companies across tech/SaaS, e-commerce, professional services, real estate, manufacturing, and crypto/web3 – especially when operations are multi-entity, multi-jurisdiction, or investor-facing.

Protect your business from penalties and ensure every return, report, and remittance is handled on time, every time.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.