- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

We design and run CFO-grade finance architecture, integrating accounting, payroll, billing, and BI into a single, governed workflow. Fewer manual exports, faster closes, and reporting that holds up under scrutiny.

We design and run CFO-grade finance architecture, integrating accounting, payroll, billing, and BI into a single, governed workflow. Fewer manual exports, faster closes, and reporting that holds up under scrutiny.

Spend less time exporting data and more time acting on it.

We audit your finance stack end-to-end. Including: systems, data flows, close workflow, controls, and reporting dependencies – so the root causes of delays and inconsistencies are visible.

We design the target finance architecture and execute integrations/migrations that match your operating reality (multi-entity, cross-functional, investor reporting), with clean mapping, testing, and cutover planning.

We automate recurring workflows (close, approvals, reconciliations, consolidation) and put governance in place: role-based access, audit trails, change control, and standardized reporting packs.

Disconnected tools and spreadsheet stitching create blind spots, slow the close, and increase audit risk. We consolidate your finance data into a single, governed architecture so leadership gets consistent numbers, clear accountability, and real-time visibility – without rebuilding your team.

Get a clear picture of your loan obligations before you sign. Use our interactive calculator to estimate monthly payments, total interest, and overall loan cost tailored to your loan type.

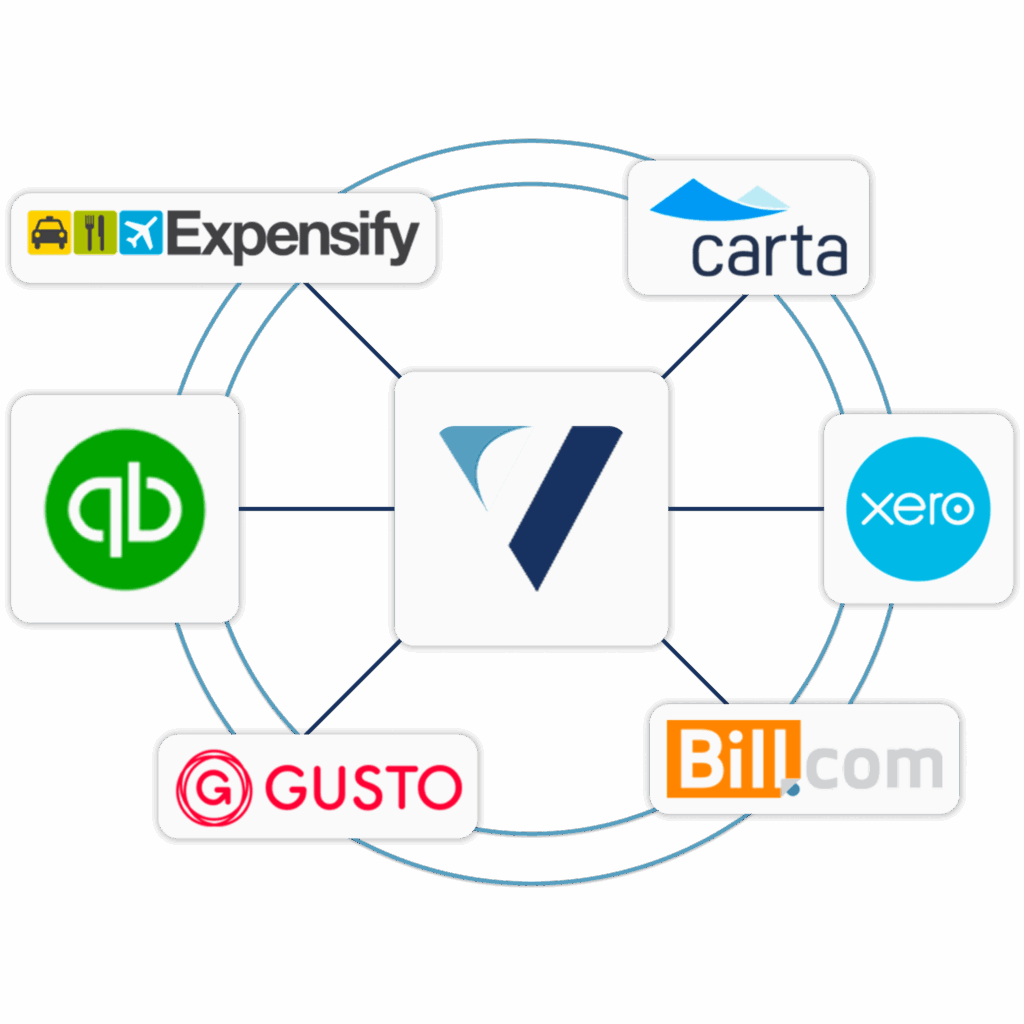

Move from QuickBooks/Xero to Intacct or NetSuite with clean mapping, historical integrity, and controlled cutover.

Connect payroll, CRM, billing, inventory, and banking into a centralized finance hub - reducing manual imports and reconciliation time.

Automate eliminations, consolidation schedules, variance analysis, and group reporting with a repeatable cadence.

Executive dashboards and management reporting in Power BI or Looker Studio - aligned to how your business actually runs.

Monthly board-ready reporting packages that clearly communicate runway, cash, and performance with disciplined definitions.

We use least-privilege access, secure credential handling, change-control tracking, and audit-ready documentation. Segregation of duties and approval workflows are built into the operating model – so accuracy holds from transaction entry through reporting.

No matter what challenge you face, our certified experts are ready to help. From taxes to systems, we ensure everything runs smoothly.

We support modern finance stacks across QuickBooks, Xero, NetSuite, Intacct, and the surrounding ecosystem (payroll, AP, expense, equity, banking, CRM, and BI). If you’re on a mixed stack, we’ll design an integration plan that fits your reality.

Yes. We handle data mapping, historical conversion strategy, testing, close readiness, and cutover, then lock in the post-migration workflow so the new system actually delivers faster closes and cleaner reporting.

We follow least-privilege access, role-based permissions, secure credential management, and change logging. We also document workflows and controls so stakeholders know what changed, when, and why.

A structured assessment of your systems, integrations, close workflow, reporting outputs, and control gaps, ending with a prioritized roadmap (quick wins + longer-term architecture plan), plus recommended tools/workflows.

Most projects run in phases. Timeline depends on entity count, history depth, integrations, and reporting complexity. We’ll provide a scoped plan with milestones after the Systems Audit.

Yes, close checklists, reconciliations, review/approval routing, supporting schedules, and variance review can be standardized and automated depending on your stack.

Yes. We design consolidation and reporting structures that handle complexity without breaking downstream board reporting.

Absolutely. We define responsibilities, integration, ownership, access controls, and change management so the project runs cleanly across stakeholders.

Yes, monthly reporting packages with consistent KPI definitions, a repeatable commentary structure, and clean ties to source systems.

Get a finance operating system that produces consistent numbers on a dependable cadence – supported by documented workflows, stronger controls, and reporting built for lenders, boards, and scrutiny.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.