- SERVING TORONTO, MIAMI, SAN FRANCISCO & NYC THROUGH CFO-GRADE FINANCE OPERATIONS

- TRUSTED BY GROWTH & MID-MARKET TEAMS ACROSS NORTH AMERICA

From on-chain activity to GAAP/IFRS reporting, we build audit-ready financials, treasury controls, and investor reporting so that you can scale with governance, not guesswork.

From on-chain activity to GAAP/IFRS reporting, we build audit-ready financials, treasury controls, and investor reporting so that you can scale with governance, not guesswork.

From SaaS and manufacturing to multi-location retail and Web3, Valua Partners supports management teams where finance precision determines growth velocity.

We convert on-chain complexity into controlled, audit-ready reporting – so leadership can forecast, manage treasury, and scale across chains and jurisdictions with confidence.

We turn blockchain activity into financial reporting you can defend. That includes wallet-to-ledger reconciliation, documented token accounting policies, consistent valuation and FX treatment, and clear revenue classification across DeFi and protocol activity. The result is faster closes, fewer surprises in audits or diligence, and reporting that works across entities, chains, and jurisdictions.

Reconcile wallets, exchanges, and subledgers to your general ledger with clear tie-outs, exception handling, and support schedules that stand up to review.

Document how you treat tokens (classification, valuation, impairment, fees) and build a repeatable close process so reporting stays consistent quarter to quarter.

Define and document the treatment of staking, DEX fees, MEV, incentives, royalties, and other crypto-native revenue events - so the P&L reflects reality.

Establish treasury workflows: approvals, wallet permissions, stablecoin policies, custody approach, and exposure reporting (counterparty + concentration).

Surface and organize tax-relevant activity and edge cases (including GST/HST where applicable) to support advisors and reduce filing and audit risk.

Monthly packages built for stakeholders: runway, treasury composition, revenue drivers, key operating metrics, and variance explanations - consistent and decision-ready.

We connect wallets, exchanges, and custodians to your general ledger so every transaction is categorized, supported, and traceable. From mapping rules and close workflows to access controls and approval policies, we build a finance stack that’s audit-ready and scalable, without breaking your day-to-day operations.

Web3 finance gets complex fast, multiple wallets, chains, revenue events, and jurisdictions. We bring structure to the close, treasury reporting, and compliance so your books are investor-ready and defensible under audit.

Yes. We implement wallet-to-GL workflows using crypto subledgers and mapping rules so transactions are categorized consistently by wallet, chain, token, and activity type. We still apply controls – variance checks, exception review, and tie-outs – so automation stays accurate.

We start with a clear token accounting memo: what the token is used for, how it’s acquired, custody structure, and what “revenue” means for your protocol/business model. Then we build repeatable classifications for common events (trading, staking, airdrops, protocol incentives, NFT sales, validator income, fees, etc.) so reporting is consistent month to month and audit-ready.

Yes – where applicable. We review your activities and billing flows, assess exposure, and implement a practical approach to indirect tax handling. For edge cases or higher-risk positions, we coordinate with tax counsel as needed so you have a defensible treatment and documentation.

Yes. We help design the reporting structure across operating entities, foundations, HoldCos, and service companies – so treasury activity, payroll/contractors, and protocol revenue map cleanly to financial statements. We also set up consolidated reporting and controls so stakeholders can trust the numbers.

We work inside secure, permissioned environments with role-based access, controlled integrations, and documented workflows. We also implement segregation of duties and approval policies around wallets and spend, and maintain audit trails for key finance activities.

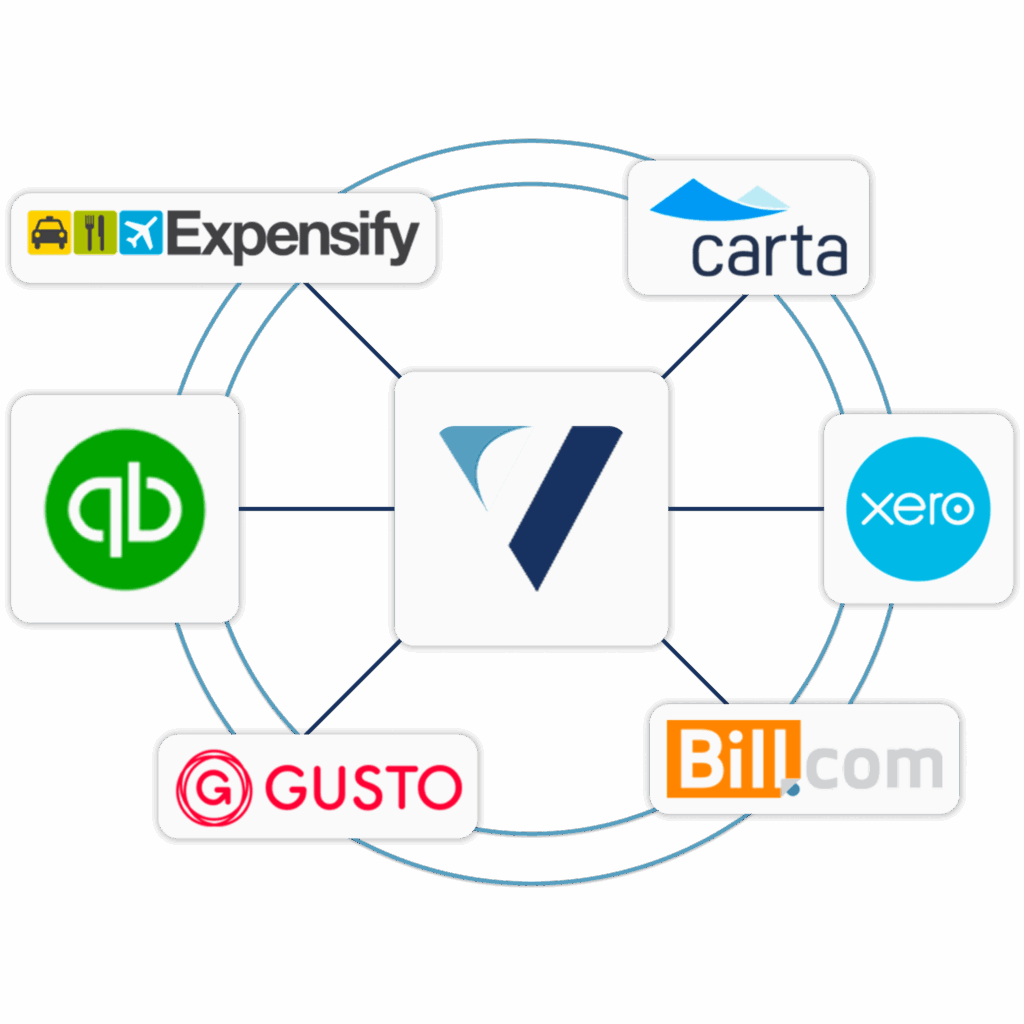

We support common custody setups (custodial and non-custodial) and can integrate leading crypto accounting tools into your GL (QuickBooks, Xero, NetSuite, etc.). We’ll recommend the stack that fits your transaction volume, chains, and reporting needs.

Absolutely. We produce board-grade reporting that ties back to the ledger – treasury position, burn/runway, protocol revenue, exchange exposure, and key KPIs – so fundraising and diligence are smoother.

Yes. We build treasury operating policies (approval thresholds, wallet roles, multi-sig governance, stablecoin/fiat conversion rules) and implement a close process that ensures wallet activity is reviewed, supported, and consistently reported.

Yes. We prepare schedules, reconcile wallet-to-ledger support, document accounting positions, and coordinate with your auditors or diligence team so requests are handled quickly and consistently.

Pricing is scoped based on wallet count, chains, transaction volume, number of entities, reporting requirements (investor/audit), and whether you need build-out vs. ongoing monthly operations. Most clients prefer a fixed monthly retainer after an initial setup phase.

Yes. We implement wallet-to-GL workflows using crypto subledgers and mapping rules so transactions are categorized consistently by wallet, chain, token, and activity type. We still apply controls – variance checks, exception review, and tie-outs – so automation stays accurate.

We start with a clear token accounting memo: what the token is used for, how it’s acquired, custody structure, and what “revenue” means for your protocol/business model. Then we build repeatable classifications for common events (trading, staking, airdrops, protocol incentives, NFT sales, validator income, fees, etc.) so reporting is consistent month to month and audit-ready.

Yes – where applicable. We review your activities and billing flows, assess exposure, and implement a practical approach to indirect tax handling. For edge cases or higher-risk positions, we coordinate with tax counsel as needed so you have a defensible treatment and documentation.

Yes. We help design the reporting structure across operating entities, foundations, HoldCos, and service companies – so treasury activity, payroll/contractors, and protocol revenue map cleanly to financial statements. We also set up consolidated reporting and controls so stakeholders can trust the numbers.

We work inside secure, permissioned environments with role-based access, controlled integrations, and documented workflows. We also implement segregation of duties and approval policies around wallets and spend, and maintain audit trails for key finance activities.

We support common custody setups (custodial and non-custodial) and can integrate leading crypto accounting tools into your GL (QuickBooks, Xero, NetSuite, etc.). We’ll recommend the stack that fits your transaction volume, chains, and reporting needs.

Absolutely. We produce board-grade reporting that ties back to the ledger – treasury position, burn/runway, protocol revenue, exchange exposure, and key KPIs – so fundraising and diligence are smoother.

Yes. We build treasury operating policies (approval thresholds, wallet roles, multi-sig governance, stablecoin/fiat conversion rules) and implement a close process that ensures wallet activity is reviewed, supported, and consistently reported.

Yes. We prepare schedules, reconcile wallet-to-ledger support, document accounting positions, and coordinate with your auditors or diligence team so requests are handled quickly and consistently.

Pricing is scoped based on wallet count, chains, transaction volume, number of entities, reporting requirements (investor/audit), and whether you need build-out vs. ongoing monthly operations. Most clients prefer a fixed monthly retainer after an initial setup phase.

Get CFO-level visibility into your on-chain operations – from wallet reconciliation to audit preparation.

This is a simplified template that allows you to create your own PE distribution waterfall for returning capital to the LPs, GPs, etc with different fund structures. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

This template is a simplified 3-statement model with a DCF and Weighted Average Cost of Capital (WACC) to demonstrate how the Enterprise Value and Equity Value of a company is determined. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate.

Build a private equity LBO model using flexible financing/debt inputs and supporting schedules. It’s plug-and-play: enter your own numbers (or formulas) and the outputs will auto-populate. The template also includes all three financial statements, a discounted cash flow (DCF) analysis, and a sensitivity analysis.

A guide to building finance-grade models with clean inputs, defensible assumptions, and stakeholder-ready outputs, including how the three statements connect and how to structure models that hold up in diligence.

Download our walkthrough of how to prepare for a valuation, what information matters most, and how professionals triangulate value using income, market, and asset-based approaches.

Use this checklist to gather documents before we prepare your T3 Trust Income Tax and Information Return. If you’re unsure about an item, include what you have, we’ll confirm what’s required.